Insider Trading

ASIA – Holdings, Inc

Holdings, Inc. and its subsidiaries provide telecom software solutions and information technology (IT) security products and services to the telecommunications market in China. Its products and services enable its customers to build, maintain, operate, manage, and develop communications infrastructure. The company operates in two divisions, Technologies and Lenovo- . Technologies division provides business support systems/operating support systems, including billing, customer relationship management, intercarrier network access payment management, and operating analysis and decision support systems and solutions; and network infrastructure solutions consisting of network access and backbone infrastructure planning, design, and implementation for telecommunications and Internet service providers. It also offers service application solutions, including messaging software to support electronic mail systems, antispam software, antivirus solution for scanning and clearing viruses before emails are downloaded, and a support platform for value-added short messaging services, as well as a network hard disk product that facilitates Internet-based file transfer, sharing, and management. Lenovo- division principally provides IT security products and services for small to medium size companies with a focus on the firewall and virtual private network sectors. This division also offers financial services IT solutions, including bank core business processing systems, bank business performance management systems, bank call center systems, and bank notification systems. Holdings was founded in 1993 and is based in Beijing.

Towards the end of November two insiders made some rather large purchases of ASIA stock. Directors James Ding and Edward Tian together bought 2.45 million shares at a total cost off $14.61 dollars. On the same day of the purchase, “On November 29, 2006, Holdings, Inc. (the "Company") entered into a Strategic Investors' Agreement (the "Agreement") with CITIC Capital MB Investment Limited, an exempted company organized and existing under the laws of the Cayman Islands ("CITIC Capital") and PacificInfo Limited, an international company organized and existing under the laws of the British Virgin Islands ("PacificInfo"). PacificInfo is wholly-owned by Mr. Edward Tian, a founder and stockholder of the Company and a member of its board of directors.”

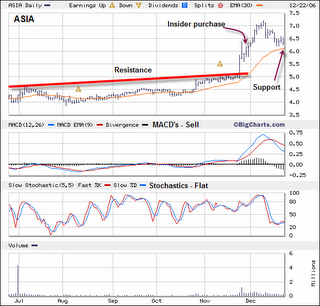

The stock has been in a consolidation mode for most of the year as it continued to bump its head up against overhead resistance at the up sloping red trendline. Then just days before the large insider purchase he stock exploded upward to new highs. On December 11th, the stock hit a 52-week high of $7.21. Once the new high was established the stock then retraced back to support at its 30-dma. The stock trades in the technology/computer networks industry which is trading at new yearly high prices. Currently, the MACD’s are revealing a sell signal while the Stochastics have rotated flat.